owner's draw in quickbooks self employed

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

I Am Setting Up An Account For Owners Draw And When Setting It Up As An Equity Account The Detail Type Does Not Have Owners Draw As A Choice What Would I

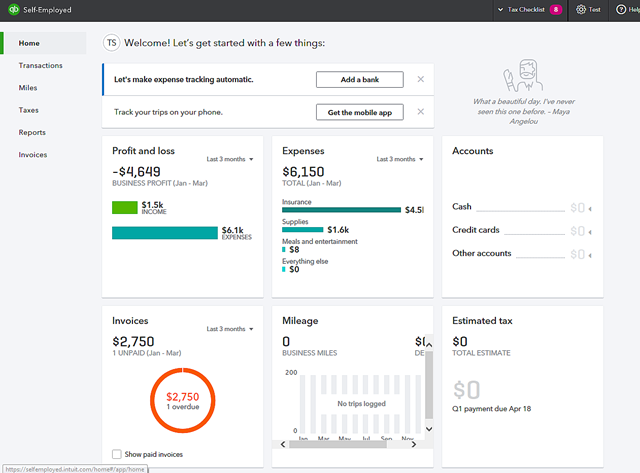

What Makes QuickBooks Self.

. Create an Owners Equity account. Instead you make a withdrawal from your owners. If QuickBooks displays the Payments to Deposit.

Click the Banking option on the menu bar at the. Select Make Deposits from the drop-down menu. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the.

Here are few steps given to set up the owners draw in QuickBooks Online. Heres how you create an Owners Equity. Click the Banking tab in the main menu bar at the top of the screen.

Before you can pay an owners draw you need to create an Owners Equity account first. Close Your Books Faster Today. To Write A Check From An Owners Draw Account the steps are as follows.

Click on the Banking menu option. What is Up in Quickbooks Self-Employed Basics for Business Owners Online. Enter Owner Draws as the account name and click OK 5.

Click Chart of Accounts and click Add 3. To ensure you start and. For background our company used Quickbooks Enterprise for.

When you create your account be sure to choose Equity or. In QuickBooks Desktop software. Select the Equity account option.

Then choose the option Write Checks. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Quickbooks Self Employed No Way To Download A General Ledger For A Month In Excel Only Profit Loss In Adobe This Does Not Help

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

What S The Scoop With Quickbooks Self Employed Insightfulaccountant Com

Quickbooks Self Employed Review 2022 Pricing Features Complaints

Get Started With Quickbooks Self Employed Youtube

Best Tax Software 2022 Self Employed And Smb Options Zdnet

Taking Self Employed Drawings How To Record Money Your Pay Yourself Using Quickbooks Online Youtube

Quickbooks Self Employed Complete Tutorial Youtube

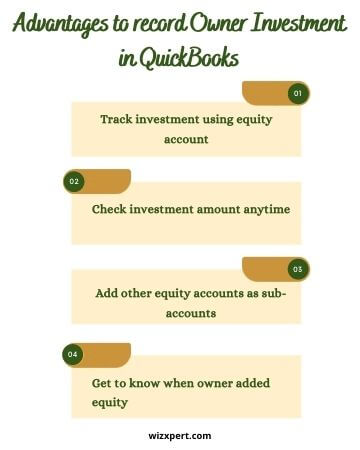

Learn How To Record Owner Investment In Quickbooks Easily

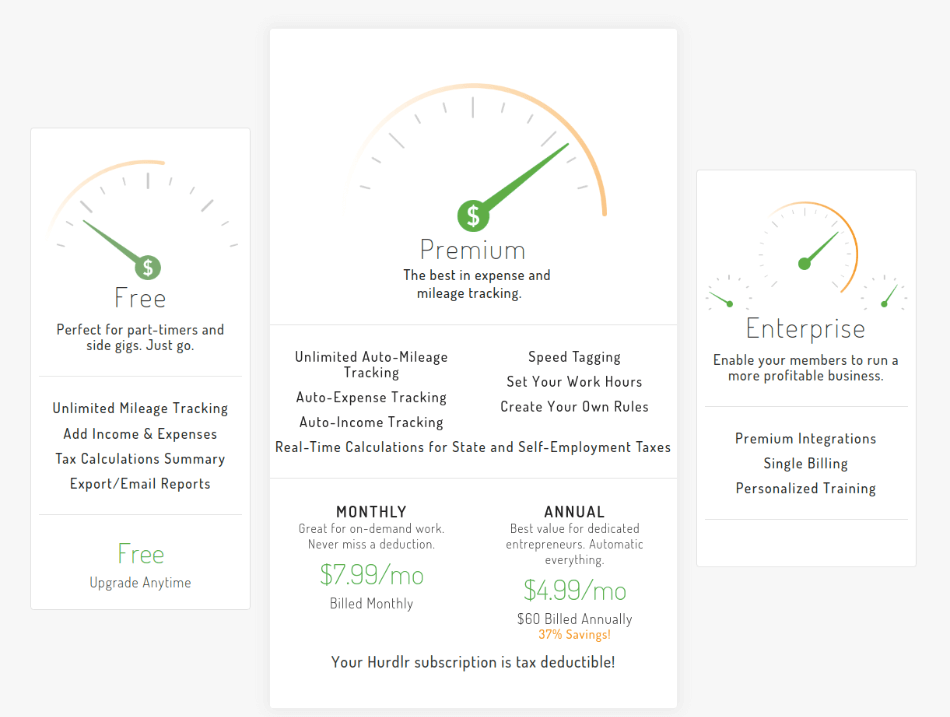

Hurdlr Vs Quickbooks Online In Depth Comparison 2021

How Do I Do Payroll As Self Employed Hourly Inc

Hi How Do I Enter Track Owners Draw Payments

Quickbooks How To Record Owner Contributions Youtube

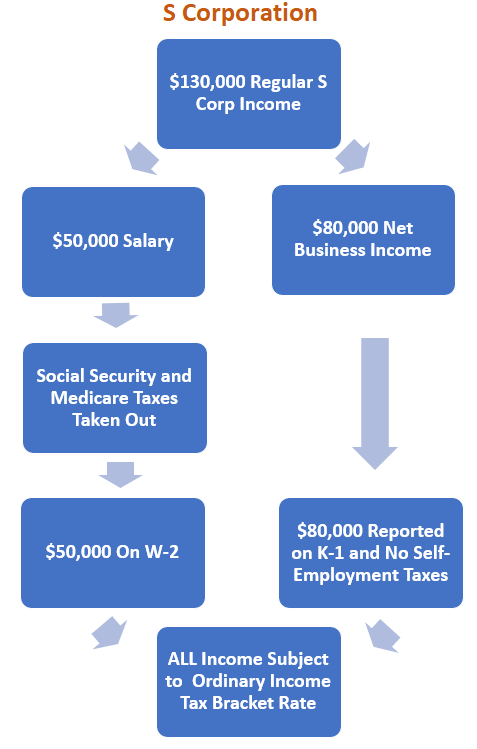

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

What Are Drawings In Accounting Self Employed Drawings

Quickbooks Self Employed Not Perfect But Better Than Nothing Insightfulaccountant Com

Get An Expert S Comparison Of Quickbooks Online Vs Quickbooks Self Employed Includes A Comparison Of Key Fea Quickbooks Online Quickbooks Bookkeeping Software

Easy Accounting For The Self Employed By Chrystal Mahan Ebook Scribd